Tuisku is an artificial intelligence and machine learning platform to optimize your trading strategies using technical patterns. Fully integrated with TraderView, Tuisku helps you make buying and selling decisions on assets including crypto and maximize your performance in the financial markets.

Open TraderView

Open TraderView

if (stochasticD <= 5.85403)

if (smoothedD_Diff > 2.31155)

if (stochasticK <= 1.36624)

decisionValue := 1.000000 // buy

if (stochasticK > 1.36624)

if (stochasticDiff <= 1.83977)

decisionValue := 0.714286 // buy

if (stochasticD > 5.85403)

if (stochasticD <= 16.8716)

if (stochasticSmoothedDiff <= -2.07631)

if (smoothedD_Diff > 12.2661)

decisionValue := -0.750000 // sell

*In TW update the candles Time: - 1Day

| Price | Name | Time frame | Net Profit ($) | Indicators Name | Net Profit (%) | Closed Trades | Win Rate (%) | Profit Factor | Max Loss ($) | Max Loss (%) | Avg Profit ($) | Avg Profit (%) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| $79.00 | Alphabet (Google) Class C |

1Day | $9,989.17 | Stochastic RSI | 1.00% | 59.0 | 55.93% | 3.06 | $1,128.00 | 0.11% | $169.00 | 1.70% |

Key: 1S00

Attached File: Stochastic_RSI.py

Associated Function: TECH_PATTERN. L_Stochastic_RSI

Full Indicator Name: Stochastic RSI

Variables it Returns: Stochastic RSI

Explanation: The Stochastic RSI generates signals for overbought or oversold conditions based on the RSI formula, increasing sensitivity to price movements.

Key Combination: 1S00

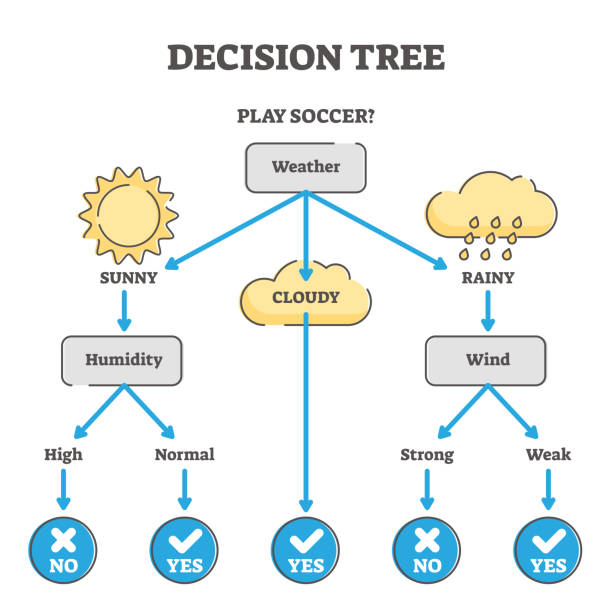

A decision tree is a machine learning algorithm used for classification and regression. In trading, it evaluates various inputs (like technical indicators) to predict outcomes, such as whether to buy or sell. Scikit-learn (sklearn) is a Python library that makes it easy to create and optimize these models.

Yes, Tuisku's strategy periodically retrains decision trees using updated market data, which ensures adaptation to market reality (this is especially important in intraday monkey candles). You can check the launch date column.

We are going to talk about the attached Pine Script strategy, which serves as an example. The rest of the strategies offered by Tuisku follow a similar structure, except in the decision_tree() function, which is adjusted based on:

You can view the full list of strategies in the "Buy Strategy" tab. This approach results in the wide variety of strategies that Tuisku offers, tailored to different trading styles and market conditions.

Tuisku’s AI trains the decision tree on historical market data using Scikit-learn’s DecisionTreeRegressor. This ensures:

You can view the full list of strategies in the "Buy Strategy" tab. This approach results in the wide variety of strategies that Tuisku offers, tailored to different trading styles and market conditions.

The script employs a structured if-else decision tree to evaluate conditions and determine trading actions:

Precision and Safety: By default, strategies aim to minimize risks:

The script evaluates market conditions using technical indicators and calculates a return value (ret) to guide trading actions: